Publications

We publish regularly. You can read and download our presentations, papers, and articles.

Enter a search query or filter by tag.

The 2023 Brokered Patent Market

Was 2023 a good year for the patent market? We are torn. When we wrote the first draft of this year's report, the data looked gloomy. But then when we dug deeper and realised that the last year turned out not be too bad.

“The 2021 Brokered Patent Market.” Richardson et. al. IAM Media (March 2022)

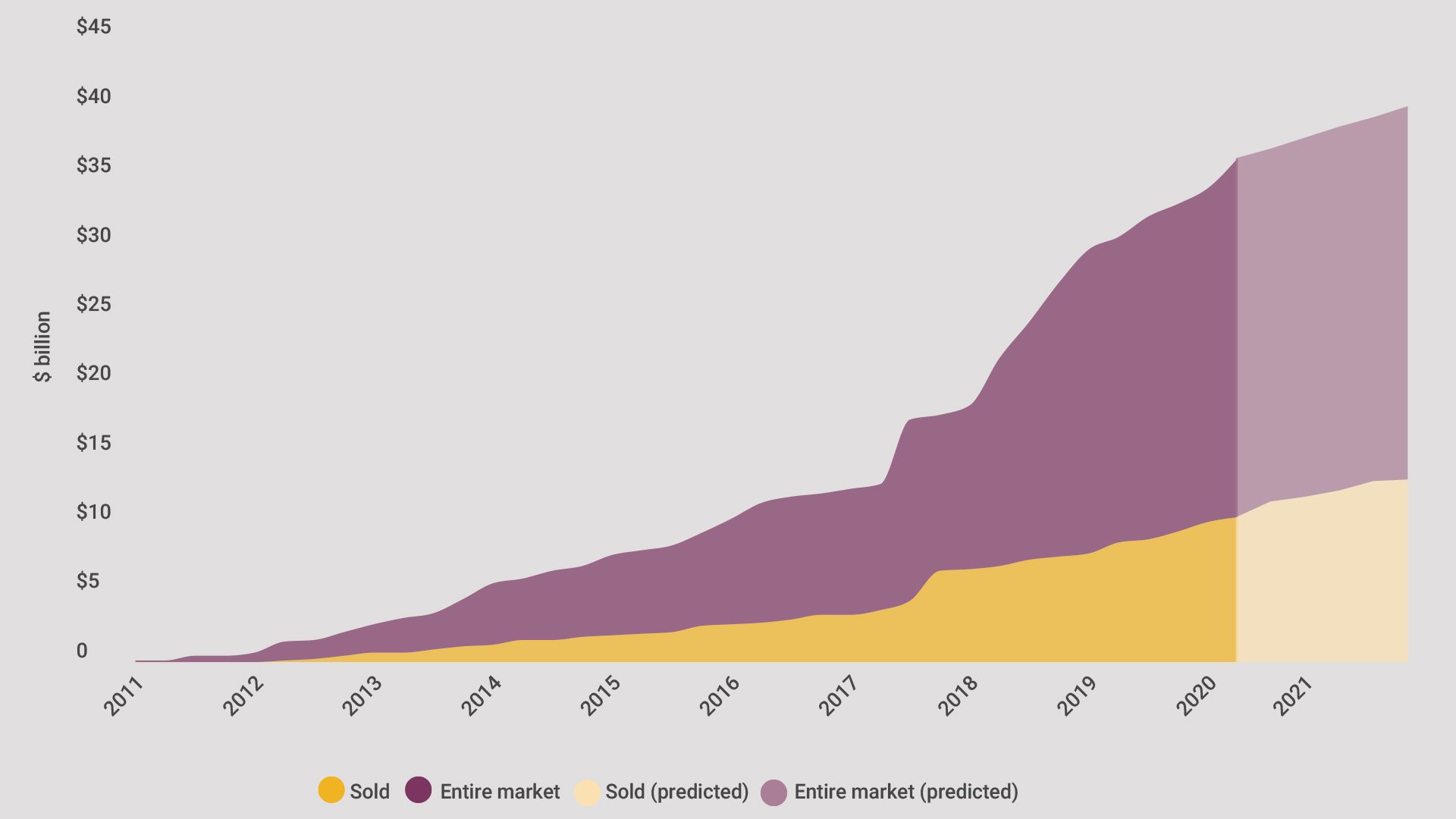

Since we started tracking the brokered patent market in 2012, we have seen more than $38 billion worth of patent assets offered on the market. As market information becomes more accessible, more companies participate and close deals.

“Measuring Diversity in Invention and Patenting Is Easier Said Than Done.” Harrison et. al. IAM Media (November 2020)

Stakeholders across the IP community are keen to increase diversity in their ranks but, as Suzanne Harrison and Erik Oliver explain, even the most sophisticated companies face a challenge in building a full picture of precisely who is participating in the patenting process.

“IAM Strategy 300 Global Leaders 2021.” IAM Media (January 2021)

The IAM Strategy 300 Global Leaders guide draws from the worlds of private practice, consulting and other service providers, with specialists from the major IP markets in the America’s, Europe and Asia.

“The 2020 Brokered Patent Market.” Richardson et. al. IAM Media (November 2020)

A surge in NPE activity is beginning even as corporate buying is declining – time to hug your defensive aggregator.